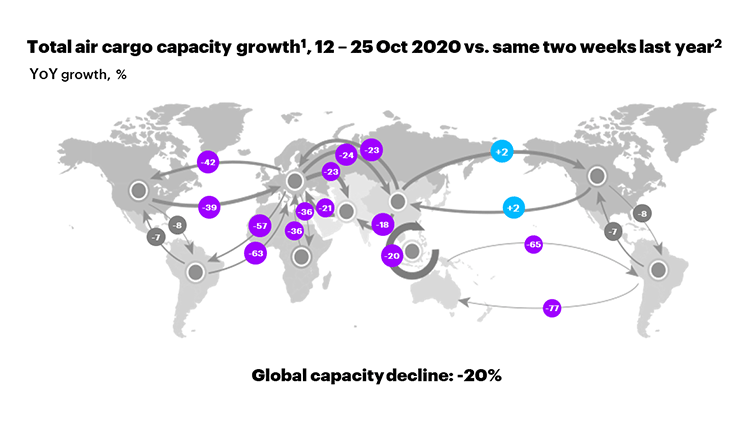

The second wave of the pandemic in Europe poses a new barrier for the already complicated airline industry. The new restrictions, with several countries in lockdown, are again affecting the economy in European countries, and will certainly have an impact on products required by the hospitality sector. For the moment there is no visible change in airfreight capacity compared with last month. According to the latest analysis by Seabury Consulting in mid-October, the reduced capacity from Africa to Europe remains at –36%, which is similar to the previous month.

Source: Seabury Consulting (Accenture) Capacity Tracking database

CARGO FLIGHTS – UPDATES

Download the Excel tool that contains information on most cargo flights available in one database. Please allow macros for the file to work properly.

Logistics country-by-country – UPDATES

The individual logistics situtation and operations for each country are listed in an Excel database. This country situation report is based on reports from the World Food Program, Bolloré Logistics and Logistics Cluster.

African Airlines Association

The 52nd African Airlines Association General Assembly was held 9–11 November. Many points were discussed about the difficult situation the airline industry and tourism is going through. The CEO of Astral Aviation, Sanjeev Gadhia, reiterated the importance airfreight has had in this pandemic, and how airlines are now creating cargo divisions. The next challenge will be global distribution of vaccines, which will require the capacity of around 8,000 Boeing 747s. Africa’s main problem will be that only three airports have the required conditions for vaccine distribution: Addis Ababa, Nairobi and Johannesburg. Another big change in Africa is the growth of e-commerce, which could drive interesting new markets for the region. Alexander de Juniac, CEO of IATA, reports that the situation is critical: passenger traffic in Africa is down 89% on usual demand, which has already caused the bankruptcy of at least four African airlines. He urged governments to intervene and save the airlines. Currently, quarantine measures required by some countries are causing the same impact as border closures, so people are not travelling except when absolutely necessary. He suggests that systematic testing before travel could be a much better solution that would avoid total disruption of the flow of passengers.

The coming months will be crucial to see if the pandemic can be controlled and if the flow of passengers will increase a little on the first quarter of 2021. But, according to experts, the airline industry expects to return to 2019 levels only by 2023, if vaccination is successful.

International flights rise steadily after restrictions eased

Since the reopening of the country’s air borders in September, information from the Ghana Airports Company reveals that 19 airlines have fully resumed flight operations to the Kotoka International Airport. In the past 2 months, the frequency of flight schedules has ranged between twice a week to 14 times weekly (Ghana Web, 2 November).

ICAO CART guidance crucial for Africa’s economic revival

The International Air Transport Association (IATA) is urging Africa’s health and transport authorities to accelerate and expand the harmonised implementation of the International Civil Aviation Organization’s (ICAO) Council Aviation Recovery Task Force’s (CART) guidance for the safe resumption of air travel and tourism during the Covid-19 pandemic. Three main suggestions are: Covid-19 testing; public health corridors or travel bubbles; and regulatory alleviations until 31 March 2021 (IATA, 11 November).

Astral to start flying B767F from ATSG

A new aircraft for Kenyan airfreight company Astral will enter into service in December 2020, to serve the needs of customers throughout intra-African and Middle East networks. The new aircraft, a B767F, has a 42-tonne payload and 350 cubic metres volume (Logistics Update Africa, 29 October).

EMIRATES CALLS A380S UP FOR ALL-CARGO DUTIES

The cargo market has pivoted to such an extent that Emirates SkyCargo is now able to utilise its A380 aircraft – known for its low cargo capacity compared to its size – as mini-freighters It said it had taken the decision to introduce dedicated cargo operations on the A380 aircraft in response to the surge in the demand for air cargo capacity required for the urgent transportation of critical goods, including medical supplies for combatting Covid-19 in regions experiencing a second wave of the pandemic. Rates have reflected a ramp up in volumes over recent weeks. Tac Index data shows that rates from Shanghai to Europe increased from $4.01 per kg at the start of October to $5.54 per kg last week. From Shanghai to North America prices increased from $5.15 per kg to $7.74 per kg over the same period. (Air Cargo News, 11 November).

Emirates SkyCargo supports the horticulture industry

Emirates SkyCargo has added 10 additional weekly flights from Nairobi to the Middle East, Asia and Europe in order to carry horticultural produce, to enable farmers reliant on food exports to make their livelihoods in these challenging times (Logistics Update Africa, 31 October).

NAM, Kuehne+Nagel renew freighter aircraft agreement

Operating a minimum of four flights per week from Nairobi, Kenya to Liege, Belgium and Doncaster, UK, Network Airline Management (NAM) provides B747F capacity up to a maximum payload of 120,000 kg per flight. This vital air bridge between Africa and Europe ensures the fresh supply of flowers and vegetables to the supermarkets in the UK as well as mainland Europe (Logistics Update Africa, 3 November).

Airlines react to new UK lockdown

Airlines have cancelled flights and called for additional government support after the UK announced plans to enter a second lockdown for at least a month due to rising cases of Covid-19. The new restrictions, which come into force on 5 November, mean that all UK residents are banned from non-essential international travel (Routes Online, 2 November).

Bollore Logistics: Special task force for vaccine transport

Bollore Logistics is planning ahead and preparing for all possible scenarios, including active and passive packaging solutions. In anticipation of the marketing of 15 billion doses of Covid-19 vaccines, the company has created a task force of experts from its network, with a view to designing logistics solutions ensuring the seamless distribution of the vaccines as soon as they are marketed (Logistics Update Africa, 11 November).

Asky Airlines resumes flights to Gambia

Asky Airlines of Togo will resume operations to Banjul, Gambia from 5 November (The Voice, 31 October).

Congo Airways to resume flights to South Africa, Abidjan, Douala

Congo Airways plans to restore South Africa, Abidjan, Douala services soon. By December, Congo Airways will add two E175s to its fleet: the carrier signed a $194.4 million deal with Embraer in December 2019 for these jets (Logistics Update Africa, 11 November).

Three real solutions for air capacity shortage for flowers

The Covid-19 pandemic has placed huge pressure on global flower supply chains and their air freight capacity as Christmas and St Valentine’s approach. Jeroen van der Hulst of FlowerWatch offers three ways to turn this threat into an opportunity: packaging optimisation, to increase the quantity of flowers that can be packed in one pallet; sea freight as an alternative; creating healthy storage solutions to anticipate standstill and prevent bottlenecking (Logistics Update Africa, 9 November).

Air cargo capacity shrinks

The International Air Transport Association (IATA) released September data for global air freight markets showing that air cargo demand, while strengthening, remains depressed compared to 2019 levels with 92% of the business still present. But about 90% of international passenger traffic has disappeared (Fruitnet, 4 November).

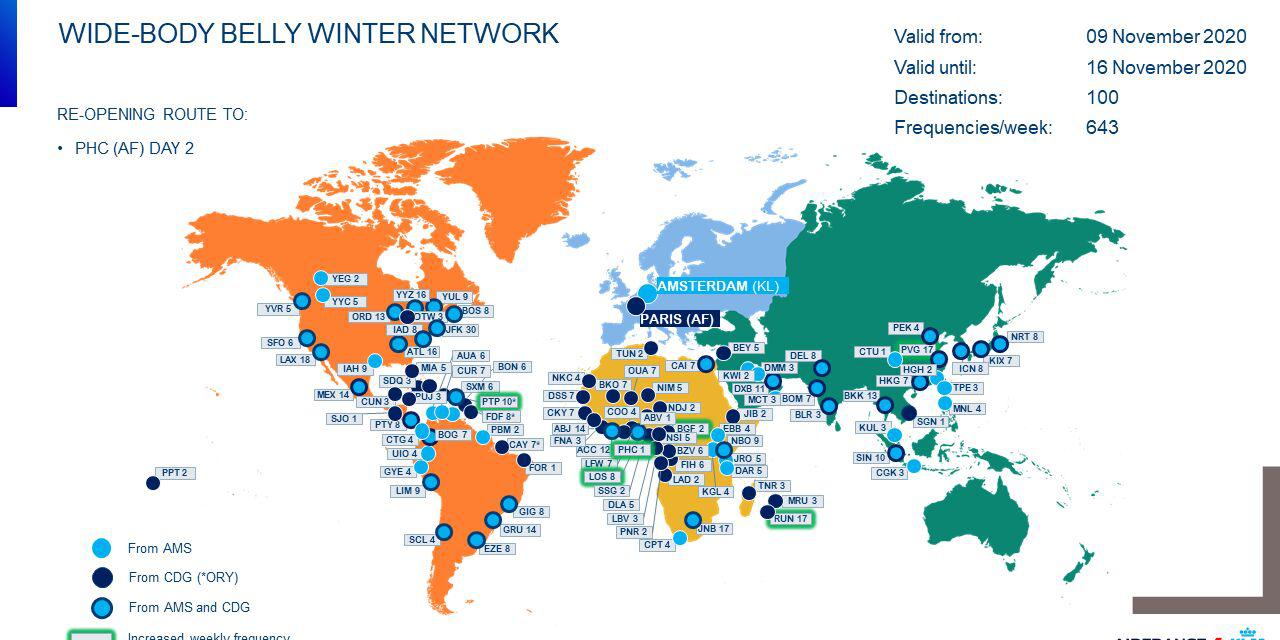

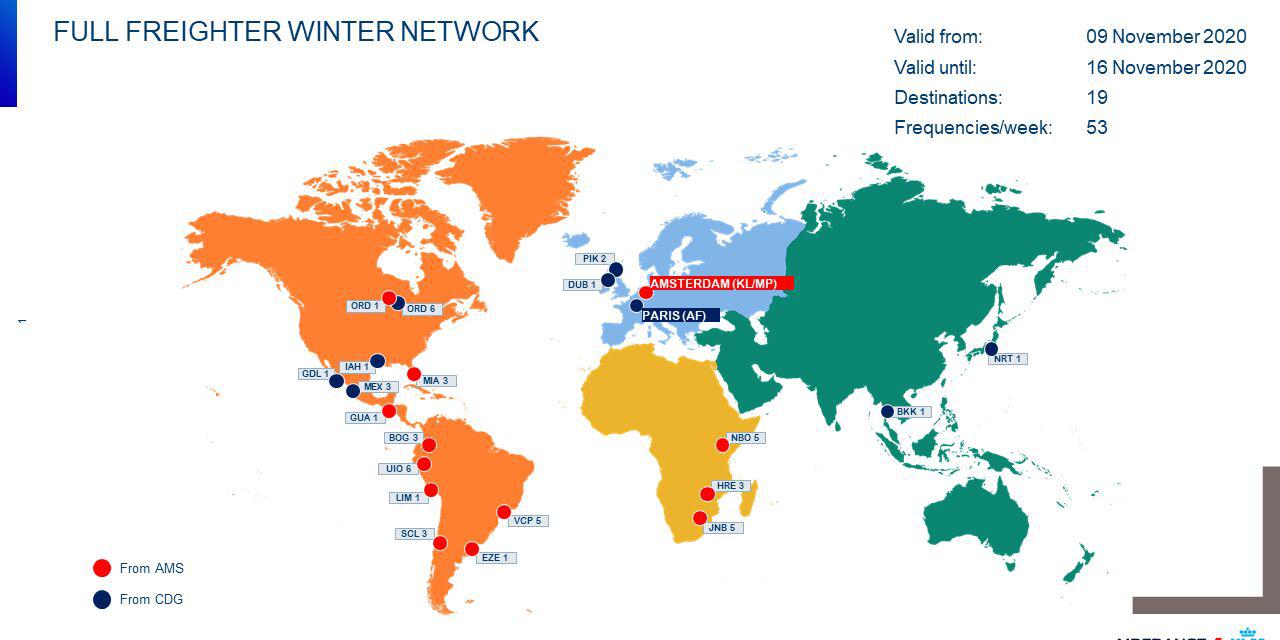

Air France KLM Martinair Cargo

Air France KLM Martinair Cargo continues to increase the number of flights and destinations of cargo passenger belly aircrafts especially from Africa to Europe. Last week AF-KLM increased the number of worldwide destinations from 94 to 100, and weekly flights from 619 to 643, compared with last month. Increased frequencies were announced for Lagos eight times a week and Port Harcourt once a week for Nigeria, twice a week for Bouca in Central African Republic, 17 flights a week for Réunion Island, and 10 times a week for Guadeloupe.

Network – Wide-body belly

Network – Full freighter

KLM NW20 Intercontinental network

KLM Royal Dutch Airlines up to 15 October filed additional changes to its Intercontinental network for Northern winter 2020/21 season, which saw extended schedule revision into the first week of January 2021. Latest adjustment as of 15 October can be viewed at Routes Online, 15 October.

Due to various travel restrictions, certain sectors may not be available for reservation in certain directions. Additional changes remain likely.

Air France KLM Group 3rd quarter results

After the lockdown, the Group observed a positive demand recovery trend until mid-August. Then the negative trend reversal for passenger activity led the airlines of the Group to adjust downwards the capacity planned for the fall and winter period, to operate around 35% of its 2019 network passenger capacity and KLM about 45% in the fourth quarter, as the group reported a 2020 Q3 loss of €1.67 billion ($1.95 billion) (Air France KLM Group, 30 October).

Lufthansa Group to operate 25% capacity in Q4

Across the group’s carriers, 125 fewer aircraft than originally planned will be operated throughout the winter. Lufthansa believes the measures will ensure its flight operations continue to be cash positive (Routes Online, 5 November).

Lufthansa NW20 Intercontinental network

Lufthansa earlier this month filed changes to its Intercontinental network for Northern winter 2020/21 season. As the airline already filed additional adjustment for the month of November, the following planned operation focuses on 01DEC20–27MAR21, as of 13 October – view it here: Routes Online, 14 October. Additional changes remain possible.

Lufthansa NS21 Intercontinental inventory changes

Lufthansa in a recent inventory update filed changes on Intercontinental routes during Northern summer 2021 season. As of 25 October, the Intercontinental services that remain unavailable for reservation between 28MAR21 and 30OCT21 can be viewed here: Routes Online, 26 October.

Brussels Airlines NW20 Intercontinental network

Brussels Airlines earlier this month adjusted planned Intercontinental operations for the Northern winter 2020/21 season. The new season sees the operation split into two parts, as the airline operates revised routing and frequencies until 14FEB21 inclusive. Normal operation (with reduced frequency) will gradually return as early as 15FEB21. Additional changes remain highly possible. View it here: Routes Online, 14 October.

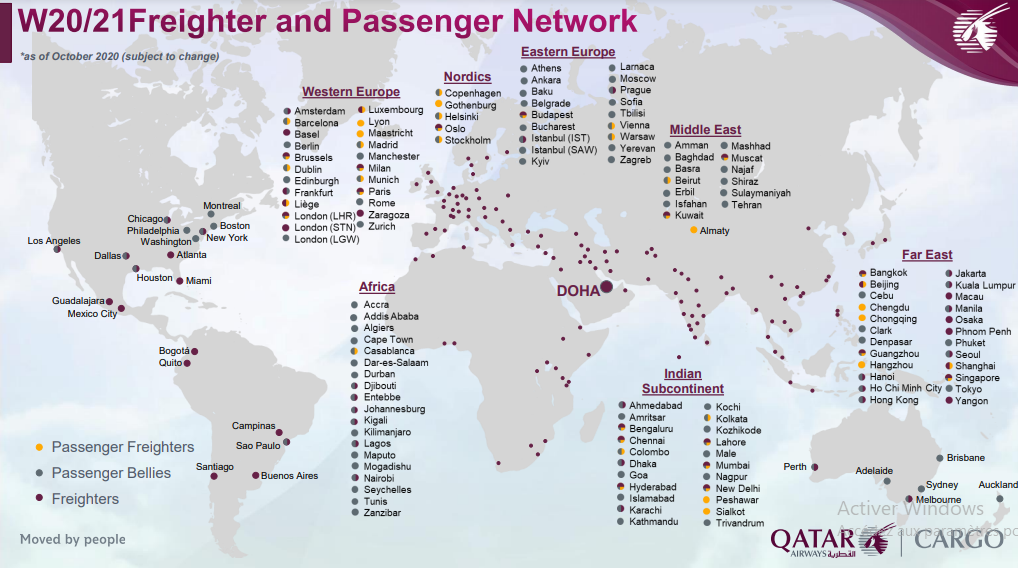

Quatar Airways

Quatar Airways’ full freighters that were coming directly from Lagos to Brussels and Entebbe and Nairobi to Liege since the beginning of the crisis and are still programmed throughout October. However it is reducing a considerable number of frequencies.

NW20 operations

Qatar Airways’ latest adjustment as of 05OCT20 includes the following. Various travel restrictions continue to impact the airline’s operation, including passenger traffic rights and limited capacity on certain directions. Additional changes to be filed in the next few weeks, in particular for schedules on/after 17DEC20. View it here: Routes Online, 6 October.

British Airways Nov 2020 Intercontinental network

British Airways as of Friday 16OCT20 filed latest adjustment to its planned Intercontinental network for the month of November 2020. Latest adjustment sees selected destinations remain cancelled or continue to be served at reduced frequencies. Planned A380 service resumption has been postponed to 01DEC20 at the earliest, in latest update. View it here: Routes Online, 17 October.

Virgin Atlantic

Virgin Atlantic resumed operations towards Africa, specifically to daily connections from London to Kenya and four times a week to South Africa. It is also an important actor for the Caribbean, connecting Antigua, Grenada, Barbados and Jamaica.

Nov 2020 operations

Virgin Atlantic in last week’s schedule update filed additional adjustment to its planned operation for the month of November 2020. As of 23OCT20, planned operation as follows. Additional changes remain highly possible. Planned one daily A350-1000XWB service to Atlanta and Johannesburg from 16NOV20 has been postponed to 01DEC20 at the earliest. View it here: Routes Online, 22 October.

Emirates

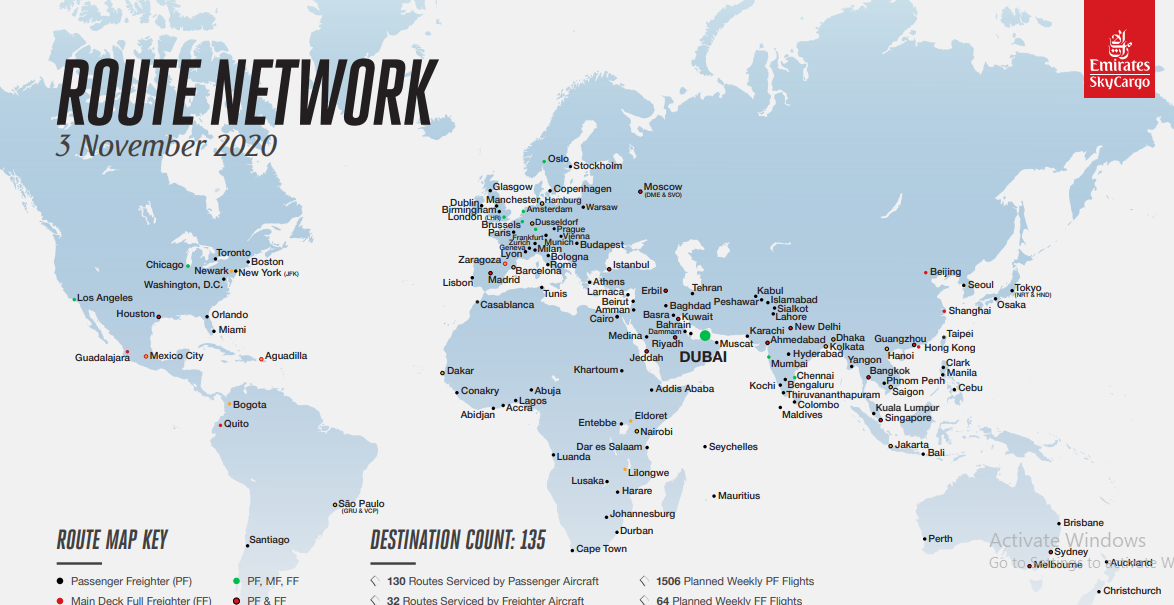

Emirates continues to increase the number of flights and destinations. Currently there are 19 countries served in Africa. A new destination is Zambia, adding to the countries already served: Angola, Côte d’Ivoire, Tanzania, Zimbabwe, Seychelles, Maurice, Tunisia, Ghana, Egypt, Senegal, Guinea, Kenya, Uganda, Sudan, South Africa, Malawi with a connection in Dubai that relies with major airports in Europe including Brussels, Amsterdam, Frankfurt, Paris, London, Madrid, Zurich, Milan, Vienna and Maastricht. Emirates labour has been crucial in maintaining the flow of goods from the African countries to 135 destinations worldwide.

Emirates NS21 Network reductions

Emirates this week filed additional changes to its Northern summer 2021 season, effective from 28MAR21. Previously reported changes for Northern summer 2021 season can be viewed here: Routes Online, 2 October.

Etihad Oct/Nov 2020 operations

Etihad in this week’s schedule update extended revised listing into November 2020, as the airline continues to restore additional routes. As of 01OCT20, planned operation for the period 01OCT20–30NOV20 can be viewed here: Routes Online, 2 October.

Note this is based on the airline’s list of destinations planned in October and November. Selected routes not mentioned (such as Los Angeles, Vienna, Beijing) are still open for reservation as of 01OCT20. Additional changes remain possible, due to various travel restrictions.

Kenya Airways

The Nairobi-based airline is announcing a reduction on its regional frequencies. Please see details below.

<4>Kenya Airways Nov 2020 international operations

Kenya Airways during the month of November 2020 schedules the following International service, including service resumption to the US. Due to various travel restrictions, additional changes remain highly possible. Based on schedule listing as of 19OCT20. View it here: Routes Online, 20 October.

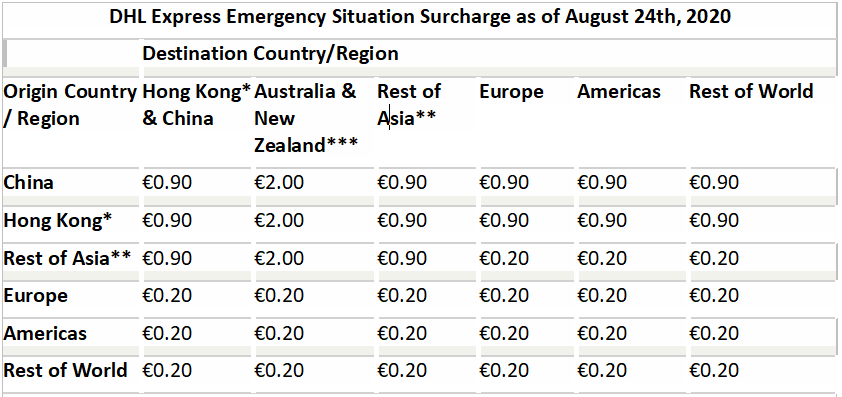

DHL

DHL’s temporary suspension of services is no longer effective for Guinea Bissau, but extended delivery times remains, it can be up to 10 additional business days for some countries of the Sub Saharan region. Also, there is an adjusted surcharge from 24 August:

** Rest of Asia (Asia excluding China and Hong Kong) = Bangladesh, Brunei, Bhutan, Cook Islands, Fiji, Indonesia, India, Japan, Cambodia, Kiribati, South Korea, Laos, Sri Lanka, Myanmar, Maldives, Malaysia, Mongolia, New Caledonia, Nepal, Nauru, Niue, North Korea, Tahiti, Papua New Guinea, Philippines, Pakistan, Solomon Islands, Singapore, Thailand, Timor Leste, Tonga, Tuvalu, Taiwan, Vietnam, Vanuatu, Samoa. Australia, and New Zealand as origin only.

***All shipments from Australia/New Zealand/Papua New Guinea to Australia/New Zealand/Papua New Guinea will be charged €0.20/kg regardless of billing location.

Ethiopian Cargo

Ethiopian Cargo remains one of the key players for the African market with its current fleet of 36 cargo aircraft (12 cargo + 24 modified passenger cargo). Its hub in Addis Ababa provides a wide range of temperature-controlled warehouses, allowing connections to Europe, Asia and America. Also there are available flights from Lagos, Lomé and Addis Ababa to Brussels and Liege. Ethiopian Cargo went from servicing 10 destinations at the beginning of the year to serve more than 70 destinations currently.

Ethiopian Airlines Nov 2020 European operations

Ethiopian Airlines in the last few days filed additional changes to its planned European operation, for the period of 25OCT20–30NOV20. Latest adjustment as of 21OCT20 can be viewed here: Routes Online, 22 October. Additional changes remain highly possible, as travel restrictions continue to impact passenger traffic rights on certain direction.

FedEx and TNT

The restrictions to most African countries were extended indefinitely, their service in Africa remains very limited. Detailed information is available here.

Air Seychelles to resume Mauritius, Johannesburg services from Nov 1

Air Seychelles will resume limited passenger services across its regional network from Seychelles to Mauritius, Johannesburg and Tel Aviv this winter (Logistics Update Africa, 2 October). Weekly flights to Johannesburg and Mauritius will start from November 1, increasing to three and two flights a week, respectively, starting December 1.

Air Burkina Sep/Oct 2020 operations

Air Burkina earlier this month updated its operations for the remainder of Northern summer 2020 season. For the period 14SEP20–31OCT20, planned operation can be viewed online here: Routes Online, 25 September.

Air Tanzania Nov 2020 International operations

Air Tanzania starting next week plans to resume additional International routes, including Harare, Kilimanjaro and Lusaka. Planned International operation for the period of 25OCT20–30NOV20 here: Routes Online, 22 October.

Rwandair Nov 2020 European service adjustment

Rwandair during the month of November 2020 is adjusting service to Europe, where the airline schedules two weekly Kigali–Brussels–London Heathrow flights, instead of three. Frequency reduction is in effect from 25OCT20 to 30NOV20, on board Airbus A330-300 aircraft. Details here: Routes Online, 21 October.

Royal Air Maroc NW20 International network adjustment

Royal Air Maroc (RAM) recently filed inventory changes for Northern winter 2020/21 season, as the airline closes reservation on various routes. As of 17SEP20, the following service is not available for reservation until 27MAR21 (exceptions may apply). Further changes remain likely, including possibility of routes restoration. View it here: Routes Online, 18 September.

Airlink

South Africa’s Airlink plans to start phasing back its regional flight network from October (Routes Online, 25 September). Seven of the eight returning routes are from JNB – to Beira (BEW), Bulawayo (BUQ), LUN, Ndola (NLA), Pemba (POL), Tete (TET) and Walvis Bay (WVB) – while the eighth will connect CPT and Windhoek (WDH). In addition, Airlink will open a new route between JNB and Maputo (MPM) in Mozambique. Flights will be 2x weekly.

Air Mauritius Nov 2020 operations

Air Mauritius during the month of November 2020 continues to operate limited service, reflected in recent schedule update. As of 20OCT20, planned operation as here: Routes Online, 21 October. Due to travel restrictions, reservation may only be available in certain direction on selected routes.

LAM Mozambique extends Lisbon service until mid-Jan 2021

Lam Mozambique in a recent schedule update extended the Portugal schedule into January 2021, which sees the airline continue to operate the Lisbon–Maputo route in the first half of the Northern winter 2020/21 season. Schedule effective 29OCT20–17DEC20: Routes Online, 21 September.

Air Senegal

In a recent schedule update Air Senegal filed changes to planned operation for Northern winter 2020/21 season. As of 09OCT20, planned operation is here: Routes Online, 12 October. Note this list focuses on operations until 31DEC20. Additional changes to planned operation remain possible.

Uganda Airlines to expand Regional network in Q4

Uganda Airlines in the Northern winter 2020/21 season intends to expand regional operation, adding service to Kinshasa from November, followed by the following destinations in December: Kilimanjaro, Zanzibar and Mombasa.

Various travel restrictions and current market conditions may impact the airline’s planned operation, including effective dates. View it here: Routes Online, 19 October.