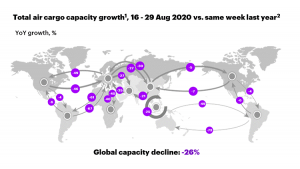

For the second month in a row, air freight capacity from Africa to Europe has shown a sustained improvement. Even with a reduced capacity of –40% in the second fortnight of August compared to the same period last year, it is showing a steady tendency toward recovery (–58% for June, –48% for July, –43% for 1–15 August).

Source: Seabury Consulting, Part of Accenture analysis (August 2020)

It is very likely that this tendency will be maintained for September, especially with Brussels Airlines covering a large part of sub-Saharan Africa, and also with new flights offered by British Airways and serving the United Kingdom market directly. It is also important to mention the companies that have remained in service since the beginning of the crisis and have now significantly increased their number of flights – such as Air France-KLM group that covers most of Africa and the Caribbean, Emirates, Turkish Airways, Ethiopian and Qatar Airways – all of them have played a key role during the crisis in order to give alternatives for air freight and keep the economy running.

As we have been reporting, most airlines have turned part of their passenger aircraft into cargo, removing seats or even carrying out bigger transformations in order to carry more cargo. Air freight has allowed many large airlines to keep flying during this situation, and even some low-cost airlines, like Scoot and SpiceJet, have been urged to develop a cargo business. According to Air Cargo News the cargo revenues of Air France-KLM in the second quarter represented 47% of the company’s revenues, the same for Air Canada with 51% in the same period. It is not surprising that a good part of the passenger flights are now only cargo flights, or a mix of passengers and cargo, as in the case of Emirates and Turkish Airways, which have expanded their number of destinations by moving their business to cargo. Passenger aircraft transformed into freighters even have a new name: “preighters”.

Although this seems very positive for African producers, the future is still uncertain, and it is difficult to foresee how long some airlines will be able to keep flying with a very small number of passengers. For African fresh produce exporters, we suggest they negotiate with airlines and freight companies the volumes needed for the coming months, especially because in some countries, such as Cameroon, production volumes usually increase from November to March. Air cargo experts foresee a new lack of cargo flights once a vaccine for Covid-19 is ready to for distribution around the world; this will probably create higher demand for cargo aircraft, and consequently a higher price for the transport of goods and reduced availability, as we saw in March and April due to masks and medical equipment. This is expected to happen in the first quarter of 2021. DHL experts predict that once a vaccine is ready, at least 15,000 flights will be needed for worldwide distribution; and an IATA cargo division representative has said it will take the capacity of 8,000 B747s to carry 8 billion vaccines if it is just one dose (see full report below). In this second rush, however, the advantage is that the airlines are better prepared, and more airlines that have developed their cargo business. Nevertheless, fresh horticultural exporters would benefit from having an alternative plan to reach their markets overseas: for example, South African blueberries have shifted a good part of their exports from air to sea (see Sea freight); and avocados have been exported from Ethiopia by rail and sea (see Road and rail).

In other news, Nigeria has banned access to most European airlines (Air France-KLM and Lufthansa) to avoid newly imported Covid-19 cases. However, we have been informed that cargo flights will still be operating from Europe to Nigeria.

Download the Excel tool that contains information on most cargo flights available in one database. Please allow macros for the file to work properly.

Download the Excel file here.

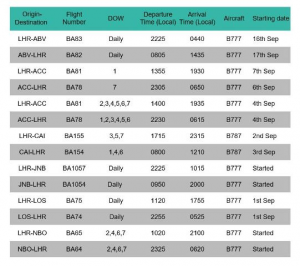

IAG Cargo updates its network destinations in Africa

IAG Cargo has updated its flight network in Africa (Aircargo News, 27 August). The carrier has added Nairobi and Johannesburg as network destinations. It is also resuming flights to and from Abuja, Accra, Cairo and Lagos.

Meanwhile, IAG Cargo saw is revenues rise in the first half of this year, despite volumes being down on a year earlier. However, the second quarter was dominated by the Covid-19 pandemic.

“Difficult air freight situation has almost returned to normal”

Although the reduced number of flights and air freight capacity had a serious impact on the supply of African fruit and vegetables to Europe, “From the end of June onwards, things gradually became more relaxed, and we can now expect almost the usual arrival of air freight. Since we mainly work with fixed prices, the price situation has not changed much,” says Cedric Timo, Managing Director of Grassfields Trading in Ravensburg, Germany (Fresh Plaza, 2 September). Nevertheless, cargo fees are still higher than last year’s level. In addition to the wholesale trade, Timo has also been operating an online store called Camerootz since the end of 2019. Apart from major African customers, Timo has been able to open up a completely new sales market thanks to an expanded product range.

SAHCO, gateway for exporting perishables from Africa to the world

Skyway Aviation Handling Company (SAHCO) plc serves as an effective gateway to export of perishables through a well-equipped transit warehouse, which provides access for other West African countries to export perishables to EU countries at optimal temperature. SAHCO provides effective transit ground handling services to major airlines through the company’s ultra-modern transit warehouse, equipped with an effective cold-room that regulates perishables to the right temperature to avoid decay. The transit warehouse is built solely to serve airlines from West Africa for the purpose of transiting their perishables to Europe through Lagos, Nigeria. Goods handled include fresh-cut fruits (pineapples, grapes, guava) in plastic containers, with a shelf life of 3–4 days. The items are packed in boxes with dry ice, and when the goods are received they are screened through X-ray and stored in the cooler/cold-room until the flight is ready. They will be on the shelves in their various destinations the following morning. The screening room is fully air conditioned to avoid a sudden drop in temperature, and the goods are also not exposed to any form of hazard. Recently, SAHCO has ordered cooler dollies from Italian manufacturer Bombelli to help transmit perishables from aircraft into the warehouse while maintaining the same temperature. The effectiveness of SAHCO’s transit operations has attracted larger Airlines including Air France-KLM. SAHCO, a major hub for export of perishables in West Africa, is RA3-certified, a requirement for ground handling companies to be able to ship to Europe, and IATA Safety Audit for Ground Operations (ISAGO)-certified.

Only approved airlines permitted into Nigeria’s airspace

Ahead of Saturday’s resumption of international flights, the Federal Government of Nigeria on Thursday said only approved airlines would be permitted into the Nigeria’s airspace (AllAfrica, 4 September). The Minister of Aviation announced that Air France, KLM, Lufthansa, Etihad Airways, Angolan TAG, Air Namibia and Royal Air Maroc were not approved to operate flights into Nigeria. He listed British Airways, Emirates, Ethiopian, AWA, and Middle East Airlines as airlines permitted into the Nnamdi Azikiwe International Airport, Abuja. He also listed Egyptair, Virgin Atlantic, Turkish Airlines, AWA, Kenya Airways and Middle East Airlines as airlines allowed to operate into the Murtala Muhammed International Airport, Lagos. In March the government had shut the nation’s airports to halt the spread of Covid-19. It later approved the resumption of domestic flights from July 8, and international flights from September 5. Explaining the reasons for the ban and the principle of reciprocity being applied to some countries, Sirika said Nigeria was simply following what each country had done to the country. A document released by the minister showed that while Air Peace (a Nigerian local airline) was excepted, some 24 foreign airlines that required ‘Foreign Carrier Operating Permit (FCOP)’ were granted but were still barred due to one reason or another, but most especially for “Restrictions on Nigerians”. See more detail here.

Q7 Air Cargo invests in perishables specialist Airflo

Dubai-based logistics firm Q7 Air Cargo is to acquire an interest in the Dutch holding company of perishable forwarder Airflo from the Dutch Flower Group (Aircargo News, 27 August). Q7 Air Cargo and its sister company, Tiger Freight, are long-term operators in the African perishable logistics industry and their participation in the Airflo businesses “will further enhance our focus on delivering superior perishable logistics solutions to our customers”, they said. Airflo has operations in Kenya and the Netherlands.

Bolloré Transport & Logistics: logistical support for the mango sector in Côte d’Ivoire, Burkina Faso and Mali

As part of the 2020 agricultural campaign, Bolloré Transport & Logistics’ operational teams processed 10,575 tonnes of mangoes (940 TEU) using air and sea transport (Agence Ecofin, 4 August). As a partner in this agricultural sector, Bolloré Transport & Logistics guarantees the maintenance of the cold chain, from the time of packing in production areas that are difficult to access, through its logistics platforms located in Côte d’Ivoire (Bouaké, Ferké and Korhogo), Burkina Faso (Bobo-Dioulasso) and Mali (Sikasso and Bamako). Regular checks are carried out to ensure that temperatures are maintained during the journey. Once they arrive at the Port of Abidjan or at the airports of Abidjan or Ouagadougou, reefer containers or pallets are stored and connected in dedicated areas while awaiting embarkation for Europe, thanks to the partnerships set up with shipowners and airlines. Faced with supply constraints linked to the effects of the pandemic at Covid-19, Bolloré Transport & Logistics has set up an alternative transport plan to ensure the routing of mango products from Côte d’Ivoire, Burkina Faso and Mali to European markets. In addition to the maritime solutions already available, the company has laid on three charter flights that have enabled the transport to Europe of 90 tonnes of mangoes from Abidjan and Ouagadougou airports.

Airfreight rates on the up in August

Air cargo rates on some of the world’s busiest routes began to pick up again in August, but the outlook remains uncertain (Aircargo News, 2 September). Looking at performance on a week-by-week basis, prices peaked in the middle of August before heading back down towards the end of the month. However, price changes do seem to have stabilised somewhat compared with previous months of the year when urgent demand for personal protective equipment met capacity limitations as a result of cuts to passenger services. Looking ahead, the market appears to be unsure what to expect for the rest of 2020. At some stage it is expected that there will be another bout of urgent demand when a Covid-19 vaccine is ready for distribution.

Lessons from Ethiopian Airlines’ success despite pandemic

In July, the World Health Organization (WHO) called on African countries to adopt comprehensive safety measures to prevent a surge in Covid-19 cases as air travel resumed (AllAfrica, 31 August). Dr Matshidiso Moeti, WHO Regional Director for Africa, acknowledged that air travel is vital to Africa’s economic stability, but even as airlines resumed operation there was a need not to let the guard down. Kenya Airways is laying off staff in phases, and some 700 of the 1,500 employees targeted in the scale down have been served with redundancy letters. In the next phase, Kenya Airways is targeting almost 200 pilots and more than 400 cabin crew. But Ethiopian Airlines, the continent’s biggest airline, dismissed reports in April that it was sending workers on compulsory leave due to the devastating impact of the coronavirus crisis. The plan was that the airline’s employees would proceed on a three-month leave without pay until the situation normalised. This could become longer if the pandemic persisted. However, the airline says that it has dealt with the crisis without seeking government bailout or reducing employee salaries. Both Kenya Airways and Ethiopian Airlines increased their cargo flights, a move that became a game-changer in the midst of the crisis. While they could not recoup their losses by operating cargo flights, the two airlines managed to pacify a blow that could have become deadly. See the full report here.

IATA: Air cargo sector must act now to overcome the challenges of vaccine distribution

Air cargo has not only been a lifeline for the financially-troubled aviation sector, it has also acted as a lifeline for global society by transporting PPE and medical items around the planet during the Covid-19 pandemic. The sector still faces challenges though, said Glynn Hughes, global head of cargo at IATA, during a conference yesterday hosted by the association (Aircargo News, 10 September). Hughes highlighted IATA’s work with regulators which helped to ensure that airport staff and crews could continue operating and processing cargo with valid certificates, despite lockdown measures in place in various countries. He also noted that a huge shortages in air cargo capacity has continued to be the biggest challenge faced by the industry in recent months, due to around 16,000 passenger aircraft being grounded. “To use some of those grounded aircraft in an innovative fashion, about 2,300 passenger aircraft were dedicated to cargo-only operations,” he said. “In order to secure cargo, specific and unique tracking systems were adopted so that cargo could be safely secured, but again we have to say that it’s been a great collaboration between regulators in the industry to get the appropriate approvals certified and issued in quick fashion.” The next big challenge faced by the air cargo sector is the significant role it will play in the transportation of Covid-19 vaccines.

Kenya Airways to increase cargo flights to China amid rising demand

Kenya Airways plans to increase cargo flights to China from once to twice a week, beginning 1 October (Floral Daily, 8 September). Peter Musola, cargo commercial manager of Kenya Airways, said it will seek to deploy two freighters between Kenya and China in order to meet growing import demand as the economy recovers following the easing of restrictions. Musola said that the bulk of Kenya’s exports consist of live crabs and flowers to China, while it imports personal protective equipment. He added that airborne flower cargo from Kenya to China has also reduced from 10 tons weekly to 2.5 tons currently due to the effects of Covid-19.

Air France KLM Martinair Cargo continues to increase the number of flights and destinations of cargo passenger belly aircraft, especially from Africa to Europe. Air France-KLM has published increased destinations worldwide (from 85 to 92) and weekly flights (from 514 to 570).

Lufthansa – Brussels Airlines Lufthansa’s schedule for September includes Senegal, Equatorial Guinea and Nigeria, and connections from Senegal to South America. Brussels Airlines currently has an active schedule to most of sub-Saharan Africa and has increased services to most of its regular destinations: Benin, Burundi, Cameroon, Cote d’Ivoire, DRC, Gambia, Ghana, Liberia, Rwanda, Senegal, Sierra Leone, Togo and Uganda.

Quatar Airways’ full freighters have been coming directly from Lagos to Brussels and Entebbe and Nairobi to Liege since the beginning of the crisis, and are still programmed throughout September.

Emirates continues to increase the number of flights and destinations. Currently there are around 18 countries served in Africa. New destinations include Angola, Côte d’Ivoire, Mauritius, Seychelles, Tanzania, Tunisia and Zimbabwe, in addition to the already served Ghana, Egypt, Senegal, Guinea, Kenya, Uganda, Sudan, South Africa, Malawi with a connection in Dubai that relays with major airports in Europe including Brussels, Amsterdam, Frankfurt, Paris, London, Madrid, Zurich, Milan, Vienna and Maastricht. Emirates labour has been crucial in maintaining the flow of goods in the African countries, with more than 10,000 flights in the past 3 months to 116 destinations worldwide.

Kenya Airways has converted four aircraft into cargo, connecting Nairobi to Brussels and London mainly, twice a week. You must contact their local operator in order to see availability. Prices reported at €3 per kg.

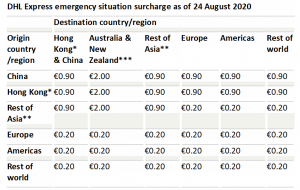

DHL: The temporary suspension of services is no longer effective for Guinea Bissau, but extended delivery times remain, up to 10 additional business days for some countries of the sub-Saharan region. Also, there is an adjusted surcharge from 24 August:

* Hong Kong and Macau

** Rest of Asia (Asia excluding China and Hong Kong) = Bangladesh, Brunei, Bhutan, Cook Islands, Fiji, Indonesia, India, Japan, Cambodia, Kiribati, South Korea, Laos, Sri Lanka, Myanmar, Maldives, Malaysia, Mongolia, New Caledonia, Nepal, Nauru, Niue, North Korea, Tahiti, Papua New Guinea, Philippines, Pakistan, Solomon Islands, Singapore, Thailand, Timor Leste, Tonga, Tuvalu, Taiwan, Vietnam, Vanuatu, Samoa. Australia, and New Zealand as origin only.

*** All shipments from Australia/New Zealand/Papua New Guinea to Australia/New Zealand/Papua New Guinea will be charged €0.20/kg regardless of billing location.

Ethiopian Cargo remains one of the key players for the African market, with a current fleet of 36 cargo aircraft (12 cargo + 24 modified passenger cargo). Its hub in Addis Ababa provides a wide range of temperature-controlled warehouses, allowing connections to Europe, Asia and America. Also, there are available flights from Lagos, Lomé and Addis Ababa to Brussels and Liege. Ethiopian Cargo went from servicing 10 destinations at the beginning of the year to serve more than 70 destinations currently.

FedEx and TNT – restrictions to most African countries have been extended indefinitely, their service in Africa remains very limited. Detailed information is available here.

The individual logistics situtation and operations for each country are listed in an Excel database.

Download the Excel file here.

The country situation report is based on reports from the World Food Program,Bolloré Logistics and Logistics Cluster.